By Rajeev Upadhyay

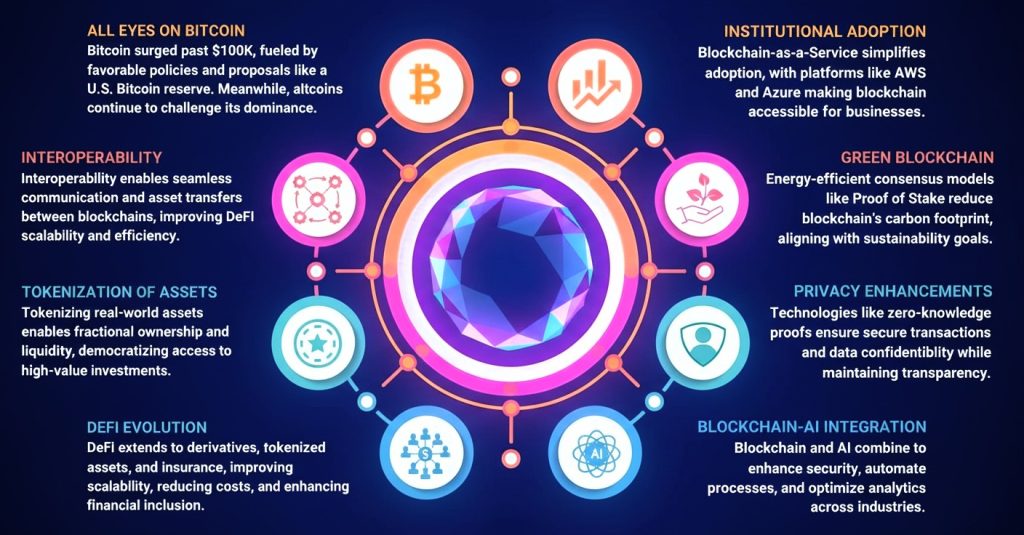

Blockchain technology has entered a transformative era. With mainstream financial milestones, robust enterprise adoption, and powerful integrations, 2025 is shaping up to be a defining year for this innovative field. The sections below unpack the latest advancements and their implications for investors, technologists, and everyday users, drawing on current data and developments across the blockchain ecosystem.

All eyes on Bitcoin

Bitcoin crossed the six‑figure threshold in late 2024 and has largely held above the 100,000100,000 mark through mid‑2025, propelled by institutional flows, ETF adoption, and clearer regulation in major markets. Analysts continue to link post‑halving supply shocks to strong price cycles, with research projecting peak windows into late 2025 as issuance falls below 1% annually. For investors, this confirms Bitcoin’s maturing role as a macro asset while highlighting volatility drivers such as policy shifts and liquidity concentration in custodial entities.

Institutional adoption goes mainstream

Enterprise uptake is accelerating as Blockchain‑as‑a‑Service offerings from hyperscalers reduce setup friction and operational burden for pilots and production systems. These services abstract infrastructure complexity, enabling industries like supply chain, payments, and identity to deploy governed networks without building bespoke stacks from scratch. For technology leaders, BaaS shortens time‑to‑value and aligns blockchain with standard cloud controls for security, observability, and compliance.

Interoperability improves scalability

Interoperability has shifted from aspiration to execution, with cross‑chain protocols and bridges now moving significant value and messages across heterogeneous networks. Standards and modular security models—such as ERC‑7683 intent formats, interchain security modules, and restaked validator sets—are emerging to unify user flows and harden bridge security. This cross‑chain fabric reduces fragmentation, unlocks multi‑chain DeFi, and prepares enterprises for workflows that span public and permissioned ledgers.

Tokenization creates new investment opportunities

Real‑world asset (RWA) tokenization is broadening access to high‑value markets by fractionalizing ownership of instruments like real estate, treasuries, and private credit on programmable rails. Liquidity benefits arise from 24/7 settlement, composability with DeFi, and transparent on‑chain registries that streamline lifecycle operations and secondary trading. For retail participants, regulated tokenized instruments promise lower minimums and improved market access, while institutions gain operational efficiency and auditability.

DeFi evolves and expands

DeFi is moving beyond spot lending and AMMs into derivatives, insurance, and credit primitives that mirror traditional finance while leveraging on‑chain transparency. Interoperability advances enable capital to flow across chains, and ZK‑rollups lower costs and latency for higher‑throughput applications without compromising settlement assurances. The upshot is a more capital‑efficient DeFi stack that can embed compliance and identity where required for institutional participation.

Green blockchain for a sustainable future

Sustainability has become a first‑class design constraint, with Proof of Stake and alternative consensus mechanisms dramatically reducing energy consumption versus legacy Proof of Work systems. Ethereum’s shift to PoS exemplifies this transition, aligning blockchain operations with climate commitments and corporate ESG mandates. As environmental disclosures tighten, energy‑efficient chains and carbon‑accounting toolkits will increasingly influence platform selection and policy acceptance.

Privacy enhancements drive trust

Zero‑knowledge proofs (ZKPs) allow verification of transactions and computations without exposing underlying data, balancing transparency with confidentiality. Beyond private transfers, ZK‑rollups deliver scalability by batching transactions off‑chain and submitting succinct proofs on‑chain, improving throughput and fees while inheriting L1 security. Cross‑chain verification with ZKPs also strengthens interoperability by proving state validity between networks without disclosing sensitive details.

Blockchain‑AI integration unlocks new potential

AI and blockchain are converging to secure data pipelines, automate compliance, and enhance analytics on tamper‑evident ledgers. AI models benefit from verifiable data provenance and event streams, while blockchains gain adaptive threat detection and intelligent orchestration across smart contracts and off‑chain agents. For enterprises, this fusion enables audit‑ready automation—from supply chain traceability to financial controls—driven by trustworthy data and explainable workflows.

What this means for different audiences

- Investors: Bitcoin’s post‑halving dynamics, ETF flows, and institutional custody are reshaping liquidity and risk profiles, while tokenized RWAs open diversified, lower‑minimum exposures.

- Technologists: Mature BaaS stacks, modular interoperability, and ZK‑based scalability reduce integration risk and accelerate delivery of cross‑chain applications.

- Everyday users: Lower fees, faster settlement, stronger privacy, and greener infrastructure improve usability and align blockchain with mainstream expectations.

Final thoughts

Blockchain is no longer just a technology; it is an expanding ecosystem solving real problems across finance, supply chains, identity, and data integrity. The combination of institutional adoption, interoperable architecture, sustainable operations, privacy‑preserving cryptography, and AI‑driven automation will define competitive advantage in 2025 and beyond. Staying informed—and adaptable—remains the most reliable edge as this landscape compounds in capability and scale.

Leave a Reply